Quick summary and our view

The Spring Statement 2023 (effectively a mini budget) might be good for the economy, but it doesn’t seem very good for companies, and is particularly harsh for small small companies. Why? Because:

- Corporation Tax is going up – this was announced some years ago, but it takes effect from 1/4/23

- The super deduction on capital expenditure has been removed – thus, companies can no longer reduce taxable profits by 130% of amounts invested

- Full expensing of investments – small companies can already fully expense investments of up to £1m/year, so this doesn’t really help

So, small companies are hit by both higher tax rates and a reduction in allowable expenses. We have searched the budget for positives for small businesses, but can’t see anything noteworthy. For example, there’s nothing about providing more assistance toward training. Perhaps rays of hope come from the Government’s confidence that the economy will grow (let’s hope so) and their creation of “12 high-potential knowledge-intensive growth clusters”, where start up funding and tax relief will be available. Pension reform will certainly help some people and the provision of child-care. is alos good news for some.

One final point – according to the Government, even after the increase in Corporation Tax, the UK will still have the lowest rate of Corporation Tax in the G7.

Summary of policy decisions

The table below summarises the policy announcements that we think will be most relevant to our business clients.

Summary of measures announced at the 2023 Spring Statement

| Measure | Detail | From | New Announcement |

| Companies | |||

| Increase in Corporation Tax | Corporation Tax on profits over £50k will increase (see below, bad news for all companies) | 1/4/23 | No |

| Abolition of Super Allowance | 130% tax relief on qualifying capital expenditure will end (bad news for small companies) | 1/4/23 | No |

| Full expensing of investment expenditure | Qualifying capital investments will be 100% tax deductible (good news for large companies, but irrelevant for small companies) | 1/4/23 to 31/3/26 | Yes |

| R&D tax relief for R&D intense companies increased | Companies with qualifying R&D expenditure of more than 40% of total expenditure can claim a higher payable credit rate of 14.5% | 1/4/23 | Yes |

| R&D tax relief restrictions on overseas R&D delayed | Restrictions on overseas expenditure eligible for R&D tax reliefs will be delayed for a year | 1/4/24 | Yes |

| Individuals | |||

| Reduction in capital gains tax allowance | The annual exempt allowance will decrease to £6k/y for individuals | 6/4/23 | No |

| Further reduction in capital gains tax allowance! | The annual exempt allowance will then be decreased to £3k/y | 6/4/24 | No |

| Increase in annual pension allowance | Annual Allowance increased from £40k/y to £60k/y | 6/4/23 | Yes |

| Removal of limit on pension lifetime allowance | Tax free pension lifetime Allowance removed | 6/4/23 | Yes |

| Savings tax reliefs frozen | Frozen at £5k/year for individual with less than £17,570 of employment income | 6/4/23 | Yes |

| ISAs frozen | Adult & junior limits frozen at £20k/y and £9k/y respectively | 6/4/23 | Yes |

| Cryptoassets | Self Assessment tax return forms changed so that amounts regarding cryptoassets need to be shown separately | 6/4/24 | Yes |

| Launch of 12 investment zones | “12 high-potential knowledge-intensive growth clusters” will be launched and businesses will have access to £80b over five years, including a single five-year tax package | Not clear | Yes |

| Energy Price Guarantee (EPG) | EPG will be maintained at £2,500/y for the typical household | 1/4/23 to 30/6/23 | Yes |

| Energy Price Guarantee (EPG) | EPG will increase to £3,000/y | 1/7/23 | Yes |

| Child care | 30 hours free childcare for eligible working parents of children aged 9 months up to 3 years | Phased from 6/4/24 | Yes |

| Other | |||

| Penalties for tax fraud | Maximum sentences for “the most egregious forms of tax fraud” increased from 7 to 14 years | Immediate | Yes |

Explanation of corporation tax increase

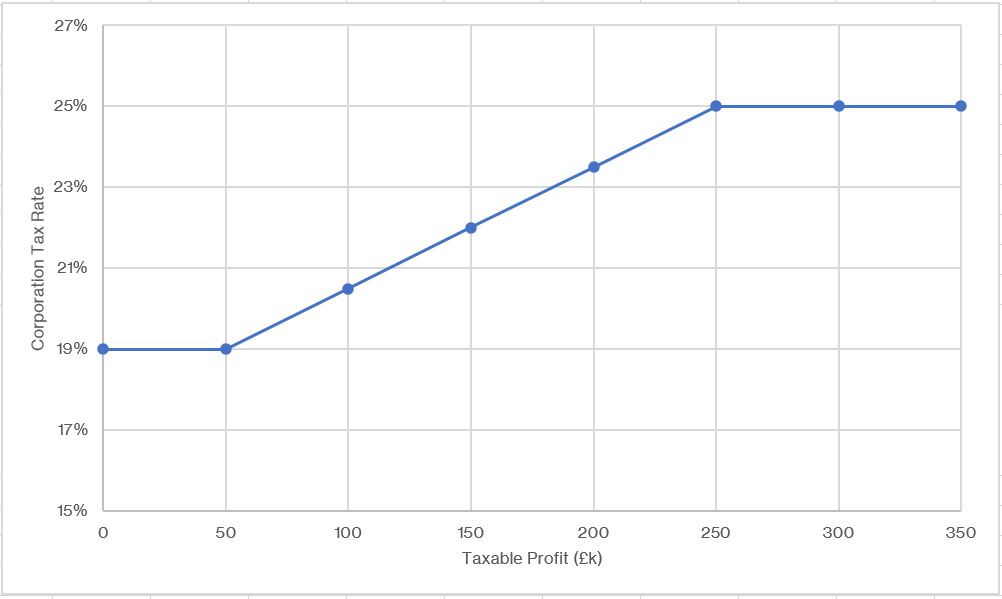

As From 1/4/2023 UK Corporation Tax for companies with profits of more than £50k will increase. Now, most companies pay 19% Corporation Tax. But from 1/4/2023 tax increases so that companies with profits of more than £250k will pay 25% Corporation Tax. Corporation Tax for companies with profits of between £50k and £250k will also increase. See the chart below.

Concluding comments

Feel free to call me if there is anything you would like to discuss.

You can read the Statement in full here

Quick summary and our view The Spring Statement 2023 (effectively a mini budget) might be good for the economy, but it doesn’t seem very good for companies, and is particularly harsh for small small companies. Why? Because: So, small companies are hit by both higher tax rates and a reduction in allowable expenses. We have […]